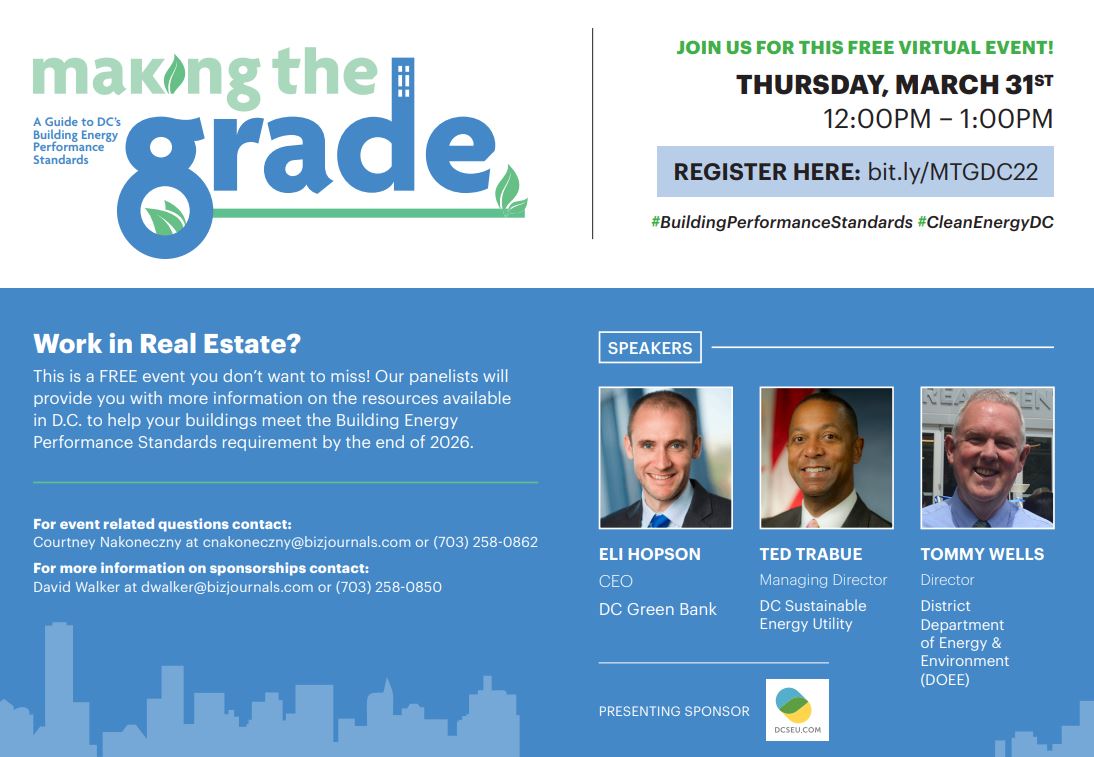

DC Green Bank and Uprise Electric Company today announced the closing of a more than $530,000 deal to accelerate the deployment of community solar across the District. The loan agreements will deliver funds for the construction of approximately 75 kW of capacity across 15 residential projects. In addition to the funds allocated for the construction of existing projects in the company’s pipeline, the deal also includes hundreds of thousands of dollars as part of a revolving credit facility to make financing available for the development and deployment of up to an envisioned 75 kW of additional community solar as well. The initial 15 sites are part of Solar for All, a program of the District’s Department of Energy and Environment (DOEE) and administered by the DC Sustainable Energy Utility that works with local solar contractors to expand the deployment of community solar and cut electricity costs for income-qualified residents by as much as 50%. The initial 15 projects are expected to create up to 13 clean economy jobs, generate more than 90 MWh of renewable energy, and avoid approximately 64 tons of CO2 equivalent annually – eliminating a comparable amount of emissions each year to an average passenger vehicle driving more than 160,000 miles.

This is the third year in a row that DC Green Bank has provided financing to a DC-based solar developer to deliver community solar projects through the Solar for All program. Eli Hopson, CEO of DC Green Bank, said of the deal, “We are excited to work with Uprise Electric to expand access to solar and strengthen the clean economy right here in the District. By continuing to invest in projects that are part of the city’s Solar for All program, we are demonstrating our commitment to ensuring that LMI families are prioritized in our accelerated transition to a clean energy future. We know that this investment model works, and we are looking forward to building additional partnerships with private lenders to replicate this success and unlock a large influx of capital into the city’s solar market.”

Uprise Electric is looking to scale up their operations and the deployment of solar across the city. Accessing affordable financing alongside Solar for All funding will allow Uprise to take a major step in that direction, and the revolving credit facility will incentivize the expansion of the company’s solar footprint and provide the company the flexibility needed to pursue multiple new projects. “I started Uprise so that we could provide homeowners in DC with the highest quality solar options regardless of income level. Partnering with DC Green Bank has helped me get closer to that goal,” Chris Sewell, founder of Uprise Electric Company, said.

Read the Full Release Below

May-2022-Uprise-Electric_DCGB-Press-Release-1